How r/WallStreetBets (almost) solved a collective action problem

Note: This post is not investment advice. And if it was investment advice, it would tell you not to gamble your savings in individual stocks, no matter how good the memes are.

What on earth is going on with Gamestop?

Depending on who you ask, it’s somewhere between a game of chicken – with day-trading Redditors barrelling towards bearish hedge funds – and a pyramid scheme in which new buyers are recruited to bail out the early investors.

But as a political scientist, perhaps the most interesting way of looking at the Gamestop story is as a collective action problem. Or, more precisely, a case study in how a loosely organized group of individuals solved a collective action problem – for a time, at least.

What is a collective action problem?

A collective action problem arises when individually rational choices lead to socially suboptimal outcomes.

The Prisoner’s Dilemma is one familiar example: If we both stay silent, we get a light sentence. But we both have an incentive to snitch in return for immunity. When we both defect, we each end up with a harsher sentence.

Collective action problems can be overcome, though. “Snitches get stitches” is just one example of how groups can create and enforce norms that change the payoffs of the original game: if I’m worried about retaliatory violence, or just the reputational costs of being labelled a “snitch”, I’m more likely to cooperate with my fellow prisoner and stay silent.

This is an example of what Mancur Olson called selective incentives. To reach the socially optimal outcome, we need a way of rewarding those who cooperate and/or punishing those who defect.

Here’s how Olson puts it in his 1965 classic, The Logic of Collective Action:

Only a separate and “selective” incentive will stimulate a rational individual in a latent group to act in a group-oriented way. In such circumstances group action can be obtained only through an incentive that operates, not indiscriminately, like the collective good, upon the group as a whole, but rather selectively toward the individuals in the group. The incentive must be “selective” so that those who do not join the organization working for the group’s interest, or in other ways contribute to the attainment of the group’s interest, can be treated differently from those who do. These “selective incentives” can be either negative or positive, in that they can either coerce by punishing those who fail to bear an allocated share of the costs of the group action, or they can be positive inducements offered to those who act in the group interest. (Olson 1965)

To the moon!

OK, so what does this actually have to do with Gamestop?

Let’s assume that based on fundamentals, Gamestop is trading at a fair price in time T1, so that it’s not rational for any short-term investor to buy it unilaterally.

But some hedge funds have large short positions in Gamestop, so if many individual investors could coordinate and go on a buying spree, they could potentially trigger a short squeeze, driving the price much higher.

To put this in a collective action framework: individuals have to take on some financial risk (buying Gamestop shares), which will yield a benefit only if many other individuals do the same.

Fortunately for the Redditors, there’s an obvious selective incentive at play here: you have to actually buy Gamestop shares if you want to materially benefit from the short squeeze!

On the other hand, once the stock has already tripled overnight it becomes much harder to make this argument to new buyers. Maybe the squeeze isn’t yet squoze, but there sure is a lot farther to fall now…

Look, for example, at the slightly desperate tone of this Reddit post, which tells users this is their “last chance of getting a discount”, and compares the trajectory of Gamestop to the 2008 short squeeze of Volkswagen stock:

A post from r/WallStreetBets proclaiming “this is the last dip guys!!”

But remember: human beings are motivated by many things besides money. And this means that the community of r/WallStreetBets has an opportunity to start creating their own selective incentives.

Vive la révolution

But the Redditors didn’t stop there. In addition to gaining peer approval, the community of r/WallStreetBets constructed another incentive to buy and hold Gamestop: sticking it to The Man.

This is probably the dynamic that has received the most commentary from the media. Like this Bloomberg story, headlined: “GameStop’s Reddit Revolution Echoes Occupy Wall Street Crusade”.

It’s pretty difficult to make this a selective incentive, though. Lots of us probably enjoyed the thought of hedge funds getting screwed over without buying any Gamestop ourselves.

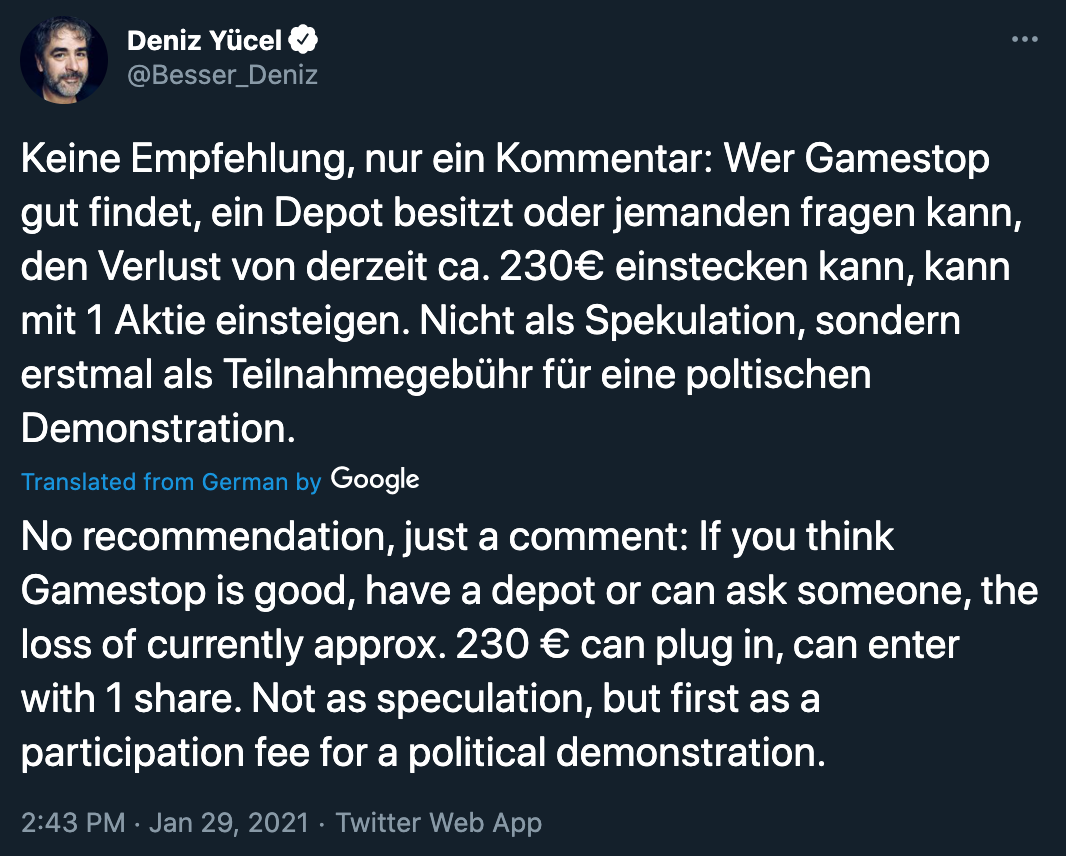

Amusingly, a German journalist tweeted that individuals should see the cost of Gamestop shares as a kind of “participation fee” to take part in a political demonstration.

(I say “amusing” because political demonstrations don’t typically charge participation fees - even when the cost of organizing a demonstration is high! - precisely because it’s not enforceable.)

Tweet comparing buying Gamestop to a “participation fee”

On the other hand, the actual posts on r/WallStreetBets often invoke something closer to revenge than revolution. Like this one that reads: “THIS IS FOR ALL THE FAMILIES THAT LOST THEIR HOMES, THEIR CARS, THEIR LIVES BECAUSE OF THE SH*T F*CKING DECISIONS FROM 2008”.

In a way, this makes more sense. After all, revenge is more than schadenfreude. It’s not just enjoying someone else’s suffering, it’s knowing that you caused that suffering.

Then again, it’s a pretty indirect link. Melvin Capital, the hedge fund that lost half its value during the Gamestop saga, didn’t even exist during the 2008 financial crisis!

And even if it did, this just isn’t a very satisfying form of revenge. Hedge funds blow up all the time. There’s a reason these guys charge “two and twenty” where the “two” means 2% of assets under management!

Here are some more personally-devastating forms of vengeance to consider:

- Keying every car parked in Mayfair

- Buying, and then burning, every Patagonia vest

- Raising taxes

FOMO

This one is perhaps the most ingenious strategy I saw on r/WallStreetBets. And it’s so simple: FOMO, i.e. “fear of missing out”.

A number of Redditors made the argument that selling Gamestop shares at a loss might reduce your financial risk but it creates a new psychological risk: you’re going to kick yourself if the stock goes back up again!

Political scientists may recognize this strategy as the minimax regret criterion: you should act in a way that minimizes your maximum regret (see Ferejohn and Fiorina 1974).

If you hold onto your Gamestop shares, your “maximum regret” scenario is that the shares go to 0. But if you sell, your “maximum regret” scenario is watching all your online friends buy Teslas and cover their “diamond hands” in actual diamonds, or whatever.

This is pretty ideal as selective incentives go, since it is enforced by the individual’s own psyche. No need for monitoring!

Conclusion

Gamestop stock price over the last 6 months

So, I spent a few hours on r/WallStreetBets, and what did I learn?

- Selective incentives matter a lot

- Those incentives can be socially constructed (e.g. peer approval) as well as mechanical (e.g. buying a stock to benefit from its rise)

- Human beings are extremely creative and naturally try to create new selective incentives in the face of a collective action problem!

- But structural features of the group (e.g. group size, exit options) still heavily influence the success of these strategies

References

Ferejohn, John A, and Morris P Fiorina. 1974. “The paradox of not voting: A decision theoretic analysis.” The American political science review 68(2): 525–536.

Olson, M. 1965. The logic of collective action: Public goods and the theory of groups. Harvard University Press. https://books.google.com/books?id=-ClHAAAAMAAJ.

Ostrom, Elinor. 2000. “Collective action and the evolution of social norms.” Journal of economic perspectives 14(3): 137–158.

Social recognition

One very important non-financial incentive is social recognition and approval. That’s essentially the basis of sites like Reddit, which have their own social currencies.

But how can this incentive be applied selectively? After all, anyone can post on r/WallStreetBets saying they just bought 100 Gamestop shares, but how can users verify that?

One technique is for users to post screenshots from an app like Robinhood, which displays their position and profit/loss. This has effectively become a requirement for anyone posting about gains or losses, lest they be met with a slew of comments demanding: “position or ban!”

The result is a genre of posts referred to as “loss porn”, in which users essentially brag about how much money they lost on Gamestop.

A series of posts on r/WallStreetBets describing significant losses on Gamestop

And whom among us hasn’t felt the sweet, sweet rush of endorphins associated with online social approval?

Still, the disciplining power of these social incentives is greatly reduced by the ease with which individuals can exit these online communities (Ostrom 2000). This is obviously a far cry from - say - the British miners’ strike, where being a scab would lead to a lifetime of total social isolation for you and your entire family.